-

-

Check Out

My Videos -

Recent Posts

- Real People with Real Solutions

- Visit My Website!

- Visit My Web Site!

- NAR June Sales Report: Home Sales DROP 5.1%

- Strategic Defaults Gaining Momentum

- You Could Get $3000. in Moving Assistance if You have to Short Sale Your Home

- More than 50% of the Sales in March were Distressed!More REOs Coming…

- How do delinquencies impair credit scores?

- More Foreclosures Coming

- President Obama is considering forcing ALL lenders to stop ALL foreclosures!

Tags

-

About Teresa

Teresa Turner is the Broker & Owner of Teresa Turner Realty Services, LLC, which specializes in short sales and loan modifications. She provides creative solutions to help people with today's complicated real estate situations. She has over 20+ years of experience in real estate, financing, negotiating, and is a Certified Short Sale Specialist trained by the Harris Real Estate University and a Loan Modification Specialist trained by the United Mortgage Modifiers Association of America. By providing homeowners with options before their property is foreclosed upon, she can create a winwin situation for all the parties involved and save the mortgage company from having to own another property. She is a real person with real solutions. Social Media

Tag Archives: turner realty

Strategic Defaults Gaining Momentum

| Did you see the story about Walking Away from your Mortgage on 60 Minutes? What is a strategic default? This occurs when the current homeowner is able to pay their mortgage but because they feel they are too underwater or simply are sick of the mortgage albatross, decide to stop paying. So much for that pride of ownership.

According to a study conducted by the Kellogg School of Management. When the study was released it was estimated that 26 percent of current defaults were strategic in nature.

T Is it tempting for you to just leave the keys on the table and get out from underwater? Does the option of renting for the next 4 to 5 years look pretty appealing to you right now?

If you have not looked at all your options- then please explore them before making a fast decision just because everyone else is doing it or just because you may have been sold some bad information. A strategic short sale may be an option for you. You may be able to negotiate down the balance you owe to a very small amount on which you can then execute a small promissory note for. Some homeowners have been able to get strategic defaults approved by offering pennies on the dollar of what they owed. Strategic short sales on first loans are most often easy to get negotiated to approval. HELOCS are another story- that is when you took out a home equity line of credit after you bought your house and then you used that money to buy cars or trips or pay for college tuition or to buy other properties. HELOCs are held in secondary position and there is not much benefit for them to foreclose on you. So they most often will charge your loan off after you don’t make payments and then sell that debt to collection agencies who will seek to collect from you for a very long time. Different states have different rules but in general the credit reporting agencies will leave that charged off debt on your credit report for 7 to 10 years. But the kicker is that when the time is near to get it released the collection agency sells the debt to another collection agency who then starts the process all over again. How long can you hide from them? What state do you live in and how do your credit laws protect your assets or not in your state? Something to think about. But you can negotiate a settlement with your HELOC and then that will wipe out the major part and the only part you will be now paying on and be liable for is the part you negotiated the debt down to. You are going to be asked to do that very same thing when the collection agency takes you to court to get a judgment against you. Why not take care of it now to avoid all of that hassle and stress later on down the road? If you do a short sale and you are late on your payments only because your lender told you to be late in order to complete your short sale and you are doing the short sale because you are moving to another area for a job- FHA may allow you to buy a home right away. Most homeowners who go into foreclosure will be able to buy another home in about 5 to 7 years but FHA will not approve your loan until you take care of your judgments. Have you thought about that? If you do a short sale you can get an FHA loan or a Fannie Mae loan within about 2 to 3 years conservatively speaking. There are a lot of other differences in getting a future home loan after a foreclosure and after a short sale. You may want to visit the Fannie Mae website to find out more. Nothing in this article is to be construed as legal advice. Please seek the advice of your attorney. I am not an attorney and I am not giving you legal advice. |

Posted in Loan Modifications, Teresa's Real Estate Blog

Tagged destin loan mods, destin real estate, destin short sales, short sales tallahassee, tallahassee loan mods, tallahassee real estate, tallahassee short sales, teresa turner, teresa turner realty, turner realty

Comments Off on Strategic Defaults Gaining Momentum

You Could Get $3000. in Moving Assistance if You have to Short Sale Your Home

Many homeowners are suffering from financial troubles and as a result they are having problems when it comes to their monthly mortgage payment. As a result, months ago the Obama administration began the Home Affordable Modification Program (HAMP), which was set in place to help homeowners through a variety of plans that would make their mortgage more affordable.

However, with underwater mortgages becoming such a problem there are very few options available to help homeowners in this position as many lenders don’t like the idea of principal reductions or where a home has lost so much value, many homeowners simply want to get out.

While it’s understandable that a homeowner who owes a substantial amount more on their mortgage than their home is worth would want to be rid of that bad situation, it seems that rather than walking away from their home all together and ruining their credit, many homeowners are looking to short sale.

Some lenders are willing to work with a homeowner when it comes to selling their home at a loss and many homeowners are willing to take this route as they see their home being in a position where it will not regain value anytime in the near future.

There is an incentive, according to reports, where if a lender allows a homeowner to sell their home at a loss they will get a $3000 moving incentive to help with the costs of relocating. While short selling does have troubles as well, since many homeowners have to deal with primary and secondary lenders, anyone who is looking to short sell their home may want to contact the lender about this incentive if they short sale.

This may not be offered from every lender but homeowners that want to short sell should at least look into this moving incentive, as well as, an agreement where if they short sell they will be forgiven the remaining mortgage principal on their home. If a homeowner short sales and still owes money to the bank it does little good seeing as how they will be paying money on a home in which they no longer live.

More than 50% of the Sales in March were Distressed!More REOs Coming…

“Public policy is delaying the pig in the python,” Zelman told an auditorium full of real estate types. “The pig has lipstick.” Zelman is referring to the shadow inventory of foreclosures (the pig) that is making its way through the nation’s financial system.

The average number of days from when a borrower stops paying on their mortgage to when the bank sends out the first foreclosure notice is 417, Zelman notes, and the final foreclosure can take up to a year more.

Let me just first give a little background for those of you who don’t know Ivy Zelman. She’s the former Credit Suisse analyst who called the housing crash, even before the boom had peaked.

She’s famous for a simple excel chart that showed the timing of subprime mortgage resets, and while she got plenty of criticism for being a big bad bear, she was right.

So even though Zelman’s now making boatloads of consulting cash at her own firm, I still like to hear her latest musings, so this morning I headed over to the Urban Land Institute’s Washington Real Estate Trends Conference, where she was keynoting a session.

“Public policy is delaying the pig in the python,” Zelman told an auditorium full of real estate types. “The pig has lipstick.” Zelman is referring to the shadow inventory of foreclosures (the pig) that is making its way through the nation’s financial system.

The average number of days from when a borrower stops paying on his/her mortgage to when the bank sends out the first foreclosure notice is 417, Zelman notes, and the final foreclosure can take up to a year more.

…What….can you please repeat that one….did she just say, the average number of days someone can live in their home PAYMENT FREE before the foreclosure notice is filed….is….417. Wow…just plain WOW!..

….and then they can stay in the home for up to a year more due to massive backlog of foreclosure filings. So, lets assume these numbers are correct..and the average Mr and Mrs. Joe can live in their homes for 800 days…agents, that is over 2 years. Now, lets add a short sale into the mix..and maybe an attempted loan mod…..Realistically, someone can live payment free for literally..years.

What does this mean now..what does this mean to you?

…if the literally millions of upside down sellers caught wind to the fact that they can live in their homes and pay nothing…not a cent…for over a year (let alone 2-3 years)….what do you think would happen?

PLEASE…wake up. This is happening now. If you think we are anywhere near the end of this real estate cycle…think again.

The government’s Home Affordable Modification Program, which today the Inspector General for the TARP wrote, “has made little progress in stemming the onslaught” (tell me something I don’t know), is simply delaying the inevitable and in some cases kicking the can and the cost down the road for borrowers who will inevitably redefault and for taxpayers who will foot the bill.

Zelman did a simple exercise of adding shadow inventory to the seemingly improving inventory numbers. In DC for example, she cites a 5.1 month supply of homes for sale, well below the nation’s 8 month supply. But add the shadow inventory of foreclosures, and you get a 13.2 month supply. She claims builders “underwriting ground are unaware of these headwinds.”

She also raised an interesting policy question, which we brought up on the blog yesterday. What exactly is so wrong with renting? The Administration, she notes, is pushing the limits of the FHA for low-income borrowers, touting historically positive affordability.

I too have been reading that the Obama administration may pull the plug on the home ownership tax credit. YES, the tax credit most American’s get for simply owning a home may go poof….bye-bye.

But Zelman counters that while we may be 6 percent undervalued as a nation, even markets that have overshot affordability are not moving because there’s a lot more to consider now, like supply, values, mortgage availability and jobs.

On the low end of the market, that is homes priced below $150,000, investors comprise 2/3 of the purchasers, according to Zelman. Another study out today from Campbell Surveys also found that 50% of sales in March were of distressed properties (foreclosures or short sales).

OK, a quick recent history lesson….in Jan 2010 29% of ALL Sales in the US were…Short Sales and REOs. NOW, only 2-3 months later…50% of ALL Sales in the US are…Short Sales and REOs. See the trend?

Tim and Julie Harris predicted for well over a year that by the end of 2010 70% of ALL sales would be…Short Sales and REOs. If anything, they were too conservative. It appears we will hit out prediction by mid-2010. The implications of a national housing market that is so dominated by the so-called distressed sales is rule changing. WHY? Who controls those listings…BANKS. The BANKS are the new sellers…the BANKS control the real estate industry.

Rental yields are pretty strong: 6-12 percent, says Zelman. So the market is good for investors and they’re eating up distressed inventory, which is a net positive for the housing market and the economy, and perhaps more beneficial than pushing more low-income Americans into home ownership.

The trouble of course is the higher end, over $400,000 where investors can’t buy with all cash and the mortgage market is closed. Zelman cites a 45 month supply of homes between $400-600,000.

Unfortunately, the government is ignoring the higher end of the market, and ignoring higher end borrowers who may be in trouble due to unemployment. Jumbo loans are excluded from the federal mortgage bailout. So where does recovery shake out under all this analysis?? Zelman says it will not be a “V” or a “W” but a canoe. Slowly floating sideways, I imagine.

Posted in Teresa's Real Estate Blog

Tagged destin loan mods, destin real estate, destin short sales, short sales tallahassee, tallahassee loan mods, tallahassee real estate, tallahassee short sales, teresa turner realty, turner realty

Comments Off on More than 50% of the Sales in March were Distressed!More REOs Coming…

More Foreclosures Coming

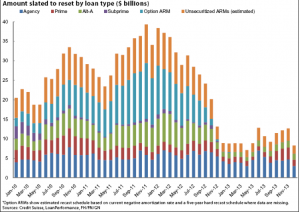

This is an updated Credit Suisse chart of the number of mortgages that have reset dates in the near future…

Why do you care about this?

Simple. Many of those homeowners won’t be able to refinance. Their homes are far too underwater and no government intervention is going to help.

These homeowners will be short sales listings..or REO listings. You need to get your mind around the massive number of homeowners that will be facing this problem in the very near future.

Most of the resets are expected to occur through 2012. Between 2010 and 2012, the chart indicates that $253.25 billion of option ARMs will adjust, while Alt-A loans totaling $163.71 billion will reset over that time. Altogether, $1.010 trillion worth of ARMs will reset or recast during the three-year period.

An interesting short term delay in the surge of option arm defaults is due to the artificially low interest rates. Thus, when the resets kicked in the house payments didn’t increase. But, what happens when interest rates DO increase…as is expected to happen soon?

Defaults. In the form of strategic defaults and foreclosures. Even IF the homeowner can re-fi..what are the chances that they will be able to afford their new house payment with the increased interest rate.

Currently its estimated that there are around 5 million homeowners who are in some form of default. Lets assume that HAMP (Home Affordable Modification Program) ’saves’ a percent of these homeowners…that still leaves literally millions of homes that must be sold. According to Credit Suisse there will be around 10,000,000 foreclosures over a 5 years period (starting in 2008).

Bottom line, this market is the new normal. Short Sales, Underwater Homeowners, REOs…low (to no) appreciation rates dominate the real estate markets for years to come.

Posted in Teresa's Real Estate Blog

Tagged destin loan mods, destin short sales, tallahassee loan mods, tallahassee short sales, teresa turner, turner realty

Comments Off on More Foreclosures Coming

2010 will be the Year of the Short Sale

From Bloomberg News:

Banks are beginning to go along with short sales in increasing numbers, three years into a U.S. housing slump that pushed the economy into a recession and cut resale values by 30 percent from the peak in July 2006. Short sales almost tripled to 40,000 in the first six months of 2009 from the same period a year earlier. Yet for each short sale, there were 25 foreclosures started or completed in the first half of this year, according to data from the Office of Thrift Supervision and the Office of the Comptroller of the Currency.

It’s really finally dawning on banks that they’re better off with a short sale,” said Richard Green, director of the Lusk Center for Real Estate at the University of Southern California in Los Angeles. “I think banks were in denial.”

Wells Fargo, Bank of America Corp. and JPMorgan Chase & Co. this year have hired and trained more staff, developed software systems for expediting short sales, and increased marketing of short sales to delinquent borrowers.

Banks are increasing such sales under pressure from the Obama administration and lawmakers who criticized them for favoring foreclosures and delaying short sales, Green said. Lenders and loan servicers also stand to receive up to $2,000 in incentives to close short sales under a Treasury Department plan unveiled Nov. 30.

New Treasury Department guidelines for foreclosure alternatives scheduled to take effect in April 2010 will require lenders to consider borrowers for a short sale on their primary residence 30 days after missing two consecutive payments on a modified loan or after the borrower requests a short sale.

The Treasury Department would pay up to $1,500 for a homeowner to relocate, $1,000 to loan servicing companies that accept a sale and a maximum of $1,000 to help settle a second mortgage or subordinate lien. A lender must agree to release the borrower from all liability for repayment for the mortgage, under the Treasury plan.

In July, Wells Fargo began mailing notices to delinquent borrowers advising them that short sales might be an option to avoid foreclosure.

“When we determine that a loan is not affordable for the customer — either because a modification was denied or failed – – we obtain the value of the property, run it through our loan decision tool and then send a letter to the customer advising them of our short sale program, including the short sale price we are willing to take on the property,” Debora Blume, a spokeswoman for Wells Fargo Home Mortgage said in an e-mail.

Wells Fargo is focusing on delinquent borrowers in Florida and California homeowners with “Pick-a-Pay” loans originated by Wachovia Corp., Blume said. Wells Fargo acquired Wachovia in December 2008 and owns the “Pick-a-Pay” loans outright, said J.K. Huey, the bank’s senior vice president overseeing short sales and bank-owned properties. That allows the company to approve a short sale without consulting investors or parties that can hold up transactions.

“Pick-a-Pay” mortgages have among the highest rates of negative equity, because borrowers could select their monthly payments, often paying less than the interest, with the difference added to the principal. That formula means that total loan debt was increasing at a time property values were falling.

Wells Fargo held $87.8 billion of such loans as of Sept. 30, down $7.5 billion from the end of last year. Wells Fargo Chief Financial Officer Howard Atkins said on an Oct. 21 earnings call that the bank is reducing the number of loans with “negative amortization potential.” As of the end of the third quarter, 26 percent of the loans in that portfolio now have minimum monthly payments that fully cover the interest due so that the total principal does not grow, up from 16 percent at the end of last year.

As of Sept. 30, Wells Fargo had modified 43,500, or 22 percent, of the distressed loans to reduce borrowers’ payments, Atkins said.

JP Morgan doubled the number of staff trained to handle short sales after adding 5,000 people since Jan. 1 to deal with distressed mortgages, said Thomas Kelly, a spokesman for the New York-based bank’s home lending division.

Chase services 10.3 million mortgages worth $1.4 trillion, according to Kelly. Of its portfolio, Chase reported 422,000 loans more than 60 days delinquent, about one third of which were in loan modification programs, according to a Nov. 10 Treasury Department report on the Obama administration’s Making Home Affordable Program.

“We’re reaching out to people who are struggling with the Obama loan modifications or our own,” Kelly said. “Approaching customers is a very recent phenomenon.”

Bank of America, the nation’s largest loan servicer, had one of the lowest loan modification rates, with 14 percent of problem loans in trial workout plans as of Oct. 31, according to the Obama Administration.

The Charlotte, North Carolina-based bank started a “cooperative short sales” program in October and may close its first short sale through the program this month, said Dave Sunlin, senior vice president for foreclosure and real estate management.

Many are borrowers with pay-option adjustable-rate mortgages issued by Countrywide Financial Corp., Sunlin said. BofA bought Countrywide, once the nation’s largest mortgage originator, for $4 billion in stock in 2008.

Short sales benefit a neighborhood because they clear out stagnant properties that may have an adverse effect on values, said Sean Shallis, a senior real estate strategist with Weichert Realtors in Hoboken, New Jersey. Shallis has one home with bank approval for a short sale and three others waiting approval on the same street in Jersey City with views of the Manhattan skyline.

“In every case we had multiple offers from people who had plenty of money to put down,” Shallis said. “Americans are out there still buying homes and trying to move it along.”

Short sales also help the bank, because foreclosed properties lose more value when they are vacant or a homeowner vandalizes a house on the way out, Sunlin said.

“We typically expect a 10 to 15 percent decrease of loss severity with a short sale,” Sunlin said.“The loss severity of short sales is lower but it’s not low,” Goodman said.

Posted in Teresa's Real Estate Blog

Tagged short sales tallahassee, teresa turner, turner realty

8 Comments

his is a trend that is picking up speed. The more negative equity you have the more likely you are to strategically default. According to the study by Kellogg School of Management, about $100,000. in negative equity is the tipping point where people will start to strategically default.

his is a trend that is picking up speed. The more negative equity you have the more likely you are to strategically default. According to the study by Kellogg School of Management, about $100,000. in negative equity is the tipping point where people will start to strategically default.