-

-

Check Out

My Videos -

Recent Posts

- Real People with Real Solutions

- Visit My Website!

- Visit My Web Site!

- NAR June Sales Report: Home Sales DROP 5.1%

- Strategic Defaults Gaining Momentum

- You Could Get $3000. in Moving Assistance if You have to Short Sale Your Home

- More than 50% of the Sales in March were Distressed!More REOs Coming…

- How do delinquencies impair credit scores?

- More Foreclosures Coming

- President Obama is considering forcing ALL lenders to stop ALL foreclosures!

Tags

-

About Teresa

Teresa Turner is the Broker & Owner of Teresa Turner Realty Services, LLC, which specializes in short sales and loan modifications. She provides creative solutions to help people with today's complicated real estate situations. She has over 20+ years of experience in real estate, financing, negotiating, and is a Certified Short Sale Specialist trained by the Harris Real Estate University and a Loan Modification Specialist trained by the United Mortgage Modifiers Association of America. By providing homeowners with options before their property is foreclosed upon, she can create a winwin situation for all the parties involved and save the mortgage company from having to own another property. She is a real person with real solutions. Social Media

Category Archives: Teresa’s Real Estate Blog

More Foreclosures Coming

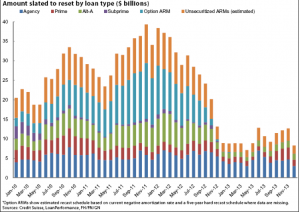

This is an updated Credit Suisse chart of the number of mortgages that have reset dates in the near future…

Why do you care about this?

Simple. Many of those homeowners won’t be able to refinance. Their homes are far too underwater and no government intervention is going to help.

These homeowners will be short sales listings..or REO listings. You need to get your mind around the massive number of homeowners that will be facing this problem in the very near future.

Most of the resets are expected to occur through 2012. Between 2010 and 2012, the chart indicates that $253.25 billion of option ARMs will adjust, while Alt-A loans totaling $163.71 billion will reset over that time. Altogether, $1.010 trillion worth of ARMs will reset or recast during the three-year period.

An interesting short term delay in the surge of option arm defaults is due to the artificially low interest rates. Thus, when the resets kicked in the house payments didn’t increase. But, what happens when interest rates DO increase…as is expected to happen soon?

Defaults. In the form of strategic defaults and foreclosures. Even IF the homeowner can re-fi..what are the chances that they will be able to afford their new house payment with the increased interest rate.

Currently its estimated that there are around 5 million homeowners who are in some form of default. Lets assume that HAMP (Home Affordable Modification Program) ’saves’ a percent of these homeowners…that still leaves literally millions of homes that must be sold. According to Credit Suisse there will be around 10,000,000 foreclosures over a 5 years period (starting in 2008).

Bottom line, this market is the new normal. Short Sales, Underwater Homeowners, REOs…low (to no) appreciation rates dominate the real estate markets for years to come.

Posted in Teresa's Real Estate Blog

Tagged destin loan mods, destin short sales, tallahassee loan mods, tallahassee short sales, teresa turner, turner realty

Comments Off on More Foreclosures Coming

President Obama is considering forcing ALL lenders to stop ALL foreclosures!

His goal may be to literally force every distressed homeowner (and their lender) to attempt a loan mod using the governments HAMP Program. We can assume that once the borrower chooses not to do a mod (or doesn’t qualify for a mod) they will then be pushed to the HAFA program. The HAFA program is all about SHORT SALES (or deeds in lieu of foreclosure).

What effect will this have on REOs? Virtually none. Why? Because of the sheer number of homes that are already in the foreclosure pipeline. Any temporary moratorium would be just that…temporary.

Obviously, the Obama Administration is watching the dramatically increasing foreclosure rates….and will do something more radical to attempt to slow the rate of folks losing their homes.

Believe me, we will be watching this emerging story 24/7. If any new news breaks…we will let you know. Here is the story from Bloomberg.

The Obama administration may expand efforts to ease the housing crisis by banning all foreclosures on home loans unless they have been screened and rejected by the government’s Home Affordable Modification Program.

The proposal, reviewed by lenders last week on a White House conference call, “prohibits referral to foreclosure until borrower is evaluated and found ineligible for HAMP or reasonable contact efforts have failed,” according to a Treasury Department document outlining the plan.

“It is one of the many ideas under consideration in the administration’s ongoing housing stabilization efforts,” Treasury spokeswoman Meg Reilly said in an e-mail. “This proposal has not been approved and there are no immediate planned announcements on the issue.”

She confirmed the authenticity of the document, which hasn’t been made public.

At present, lenders can initiate foreclosure proceedings on any loan that hasn’t been submitted for HAMP eligibility. Under current HAMP rules, foreclosure litigation can proceed while borrowers are under review for the program or even in a trial modification.

The proposed changes would prohibit lenders from initiating new foreclosure actions before loan screening by HAMP and would require lenders to halt existing proceedings for borrowers once they are in a trial repayment plan.

‘Improved Protections’

The Treasury Department will soon release guidance “which will include a set of improved protections for borrowers” in HAMP, Phyllis Caldwell, chief of Treasury’s Homeownership Preservation Office, said today in testimony prepared for a House Oversight and Government Reform subcommittee. She didn’t provide details.

This proposal goes further than rules adopted amid the crisis by federally controlled mortgage-finance companies Freddie Mac and Fannie Mae, which require lenders to review borrowers for a federal loan modification before a foreclosed property can be sold.

Foreclosure proceedings can still be initiated without a review, said Freddie Mac spokesman Doug Duvall. Fannie Mae spokeswoman Amy Bonitatibus said it adopted the same policy last March.

About 89 percent of outstanding residential mortgage loans are covered by the voluntary HAMP program.

About 2.82 million U.S. homeowners lost properties to foreclosure last year and 4.5 million filings are expected in 2010, RealtyTrac Inc., an Irvine, California data company, said last month.

Seven Million

Obama’s foreclosure prevention initiative, announced in February 2009 to help as many as 4 million Americans avert foreclosure, has modified 116,297 loans through steps such as lowering interest rates or lengthening repayment terms. More than 830,000 borrowers received trial repayment plans through January, according to Treasury data.

“Foreclosure processes differ among states, and the process is often confusing to homeowners already facing distress,” Caldwell said in her prepared testimony. “Treasury has been reviewing guidelines around outreach and the foreclosure process as part of its continual assessment of program effectiveness and transparency.”

Foreclosures may reach as many as 7 million mortgages, and an additional 5 million are at risk of default because borrowers owe more than the property is worth, Laurie Goodman, senior managing director at Amherst Securities Group LP in New York, said in a Feb. 17 interview.

Republican Criticism

“This is a problem of mammoth proportions,” Goodman said. “You can’t throw 12 million people out of their homes, so you need a successful modification program. My fear is that this isn’t it, but I’m highly confident that the administration will continue to iterate until they succeed.”

The Treasury proposal would require all borrowers who are 60 or more days delinquent on their mortgage to be sought out for participation in HAMP. Mortgage companies would need to try to contact the borrower at least four times by phone and twice by certified mail over 30 or more days before going to foreclosure.

Under current Treasury policy, foreclosure proceedings are only halted when a borrower receives a permanent modification plan.

House Republicans criticized HAMP as a failure today, saying in a report that it is prolonging the economic crisis and harming homeowners.

“By every empirical measure, HAMP has failed,” according to the 18-page report released by Republicans on the House Oversight and Government Reform Committee. “In its current form, HAMP both hurts homeowners who might otherwise spend their trial-period mortgage payments on rent and also distorts the housing market, delaying any recovery

The Truth about Short Sales

There are a lot of misconceptions about short sales in the real estate marketplace. Here are just a few of them:

1) Short Sales are impossible and never get approved. FALSE

TRUTH: Short Sales are more difficult, but they are NOT impossible. While there are no guarantees in any transaction, more and more short sales are being approved monthly. However, a Real Estate Agent MUST be educated on the process, or it will be nearly impossible. I am tenacious and I don’t take no for an answer but always look for a solution to any problem.

2) Banks are NOT accepting Short Sales; They are waiting on a bailout. FALSE

TRUTH: The reality is that banks have already been bailed out, and are really trying to do anything they can, within reason, to avoid foreclosing on a property. More banks are aggressively pursuing Short Sales and Real Estate Agents who understand how to process them. It is strictly business, it costs the bank (in most cases) far less to short sell than to foreclose.

3) You must be behind on your mortgage in order to negotiate a short sale. FALSE

TRUTH: At one time this was true, but today, this has almost all together reversed. Today lenders are looking for verifiable hardship, monthly cash flow shortfall or pending shortfall and insolvency. If you meet these three requirements and are in a position where you can not or will soon not be able to afford your mortgage, now is the time to pursue a short sale. There are a few lenders who still hold on to this rule, but they are few and far between. In fact, most lenders in any circumstance would rather sell short than foreclose.

4) Buyers are not interested in short sales and avoid them. FALSE (mostly)

TRUTH: Some buyers are not interested because of the time it takes, especially with time constraints like the First Time Homebuyer Credit. On the other hand, many agents are getting calls from buyers who say “I only want to look st foreclosures and short sales.” These have become synonymous with the term ” Good Deals”.

5) Listing a home as a short sale is an embarrassment. FALSE

TRUTH: Most sellers don’t want the world to know they can’t pay their bills, but according to recent estimates, 1 in 5 homeowners in the United States owe more on their house than it is worth. Even wealthy owners have to stop the bleeding somewhere. Most sellers are to be congratulated for admitting they need help, taking action and finding a professional who can work toward a solution.

6) The bank would rather foreclose than bother with a short sale. FALSE FALSE FALSE!!

Truth: This myth started with collection people working for lenders on commission. The reality is that banks do not want to foreclose on property, it costs too much. An average foreclosure can cost the bank up to $40,000 and they still have holding costs, insurance, real estate brokerage fees, etc. and then they still get less than market value. Do the math, which would you do?

7) There is not enough time to negotiate a short sale before a foreclosure. FALSE

TRUTH: This is a myth that hurts homeowners. Many don’t realize that the foreclosure process is lengthy. It can take a year or more, and if an attorney gets involved, it can be stalled far longer. Almost all lenders will stall a foreclosure with a legitimate contract for short sale. So if Lis Pendens has been filed, no worries, that’s just the beginning. If it is slated for the courthouse steps, hurry up, if there is an offer you may be able to stall. Don’t wait that long. Go get it on the market today with a competent Real Estate Agent who knows how to work short sales and avoid foreclosure.

Posted in Teresa's Real Estate Blog

Tagged destin short sales, short sales, tallahassee foreclosures, tallahassee short sales, teresa turner, teresa turner realty

Comments Off on The Truth about Short Sales

Problems Facing Housing in 2010

1. Short sales and REOs will continue to dominate the national real estate markets. (Expect Short Sales to be seen as ‘the solution’ for the foreclosure crisis)

2. In some markets…in the lower end price ranges…the home values have hit bottom. There will continue to be significant depreciation in homes that cost over the FHA lending limits.

3. THE FIRST HALF of this year will be stronger vs the second…why?:

4. The ‘Home Buying Stimulus’ expires in April.

5. The government is going to stop buying mortgage backed securities (MBS). This WILL result in rates increasing.

6. The FHA has made it clear that they will RAISE lending standards. (This has already started).

7. 25% of all Americans with mortgages are now upside down in their home. In many areas of Florida that number is significantly higher. There will be more homeowners deciding to rid themselves of their own ‘toxic assets’.

8. The banks are now releasing their “so-called Shadow Inventory”. Elizabeth Warren (Chair of the Congressional Oversight Committee) thinks there are as many as 15,000,000 homes that could become foreclosures…and REOs.

For these reasons we are expecting there to be a double dip in housing. What this means is that for the first half of 2010 there will appear to be a housing recovery…to be followed by more home value depreciation. Expect the most significant depreciation with homes that are above the FHA lending limits.

Posted in Teresa's Real Estate Blog

Tagged destin loan mods, tallahassee short sales, teresa turner realty

Comments Off on Problems Facing Housing in 2010

Fannie Mae Offers Subsidy For REO Purchases

Fannie Mae says it will cover the closing costs on purchases of its REO homes – an incentive the GSE hopes will help it pare down a bloated supply of repossessed foreclosed properties.

The nation’s largest mortgage financier has announced a temporary seller-assistance program under which people purchasing a property through HomePath, Fannie Mae’s REO disposition operation, will receive up to 3.5 percent of the final sales price, which can be applied toward closing costs or used to purchase appliances for their new home.

The offer is available to any owner-occupant who closes on the purchase of a property listed on HomePath.com before May 1, 2010, the company said. In addition, many Fannie Mae-owned properties are eligible for special HomePath Mortgage and HomePath Renovation Mortgage financing,

with as little as 3 percent down.

“Attracting qualified buyers to the market and reducing the inventory of vacant homes is critical to stabilizing neighborhoods and helping the market recover,” said Terry Edwards, EVP of credit portfolio management for Fannie Mae. “Many families are taking advantage of the federal homebuyer tax credit to buy a new home so this is a great time for Fannie Mae to offer some additional help.”

Recent data from Fannie Mae show an increase in the acquisition of foreclosed properties and an escalating rate of seriously delinquent loans, which means even larger volumes of REOs could be coming down the pipeline.

According to the GSE’s most recent quarterly filing, Fannie Mae acquired 98,428 homes through foreclosure during the first nine months of last year and sold 89,691 REO properties during the same period. But at the end of September, Fannie Mae still had 72,275 REO properties on its books, marking a 7 percent increase year-over-year.

Furthermore, Fannie Mae’s monthly summary shows significant growth in seriously delinquent single-family mortgages held or guaranteed by the company. Up from 2.13 percent in November 2008, loans three or more months behind in payments or in the foreclosure process soared to 5.29 percent in November 2009.

Posted in Teresa's Real Estate Blog

Tagged tallahassee foreclosures, tallahassee short sales, teresa turner realty

Comments Off on Fannie Mae Offers Subsidy For REO Purchases