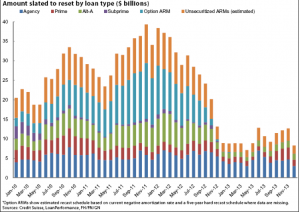

This is an updated Credit Suisse chart of the number of mortgages that have reset dates in the near future…

Why do you care about this?

Simple. Many of those homeowners won’t be able to refinance. Their homes are far too underwater and no government intervention is going to help.

These homeowners will be short sales listings..or REO listings. You need to get your mind around the massive number of homeowners that will be facing this problem in the very near future.

Most of the resets are expected to occur through 2012. Between 2010 and 2012, the chart indicates that $253.25 billion of option ARMs will adjust, while Alt-A loans totaling $163.71 billion will reset over that time. Altogether, $1.010 trillion worth of ARMs will reset or recast during the three-year period.

An interesting short term delay in the surge of option arm defaults is due to the artificially low interest rates. Thus, when the resets kicked in the house payments didn’t increase. But, what happens when interest rates DO increase…as is expected to happen soon?

Defaults. In the form of strategic defaults and foreclosures. Even IF the homeowner can re-fi..what are the chances that they will be able to afford their new house payment with the increased interest rate.

Currently its estimated that there are around 5 million homeowners who are in some form of default. Lets assume that HAMP (Home Affordable Modification Program) ’saves’ a percent of these homeowners…that still leaves literally millions of homes that must be sold. According to Credit Suisse there will be around 10,000,000 foreclosures over a 5 years period (starting in 2008).

Bottom line, this market is the new normal. Short Sales, Underwater Homeowners, REOs…low (to no) appreciation rates dominate the real estate markets for years to come.